What You Need To Know About Surviving Financial Infidelity

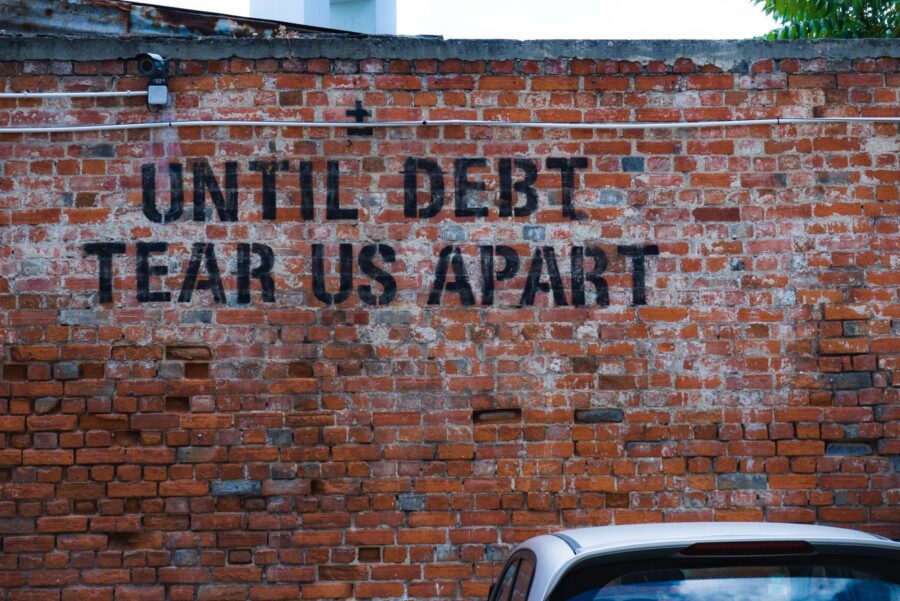

Mention the word “infidelity,” and thoughts immediately go to the bedroom and clandestine sexual rendezvous. But there are other forms of betrayal that can be just as difficult to repair. Money, for example, represents far more than a means to an end in a marriage. And surviving financial infidelity can be just as difficult as surviving sexual infidelity.

The etymology of the word “infidelity” paints its meaning with a broader brush than just the physical one we take for granted. Being “unfaithful” or “disloyal” is about character, not sex. And, when it casts a shadow over pragmatic matters, it can be as damaging to a marriage as an affair.

What does it mean to be financially unfaithful?

There are varying degrees of financial infidelity, but they all involve hiding, lying, and/or misrepresenting when it comes to money matters.

Whether you have a secret credit card or bank account, make large purchases without your spouse’s knowledge, or stash funds, it’s your intention to hide that matters. And it’s that intention that will become central to surviving financial infidelity.

Think about the covert messages conveyed by “doing your own thing” when it comes to money. What are you really communicating with money that you should be communicating with dialogue?

- I know you won’t approve, and I really want (___), so I’m just going to get it.

- Talking about finances makes me very uncomfortable.

- I don’t want to argue about money.

- I work hard, so I should be able to spend money without asking permission.

- My hobbies and habits are non-negotiable.

- I have a habit/addiction I am ashamed of, and I don’t want you to know about it.

- I don’t want to feel controlled.

- My goals aren’t the same as yours.

- I have my own life outside our marriage and home, and I don’t want you to find out.

- I’m afraid this marriage won’t last, so I’m setting myself up for financial security.

In the Free and Connected article How To Communicate With Your Spouse About Money, I open with a pithy proverb:

It’s not about the money. It never is.

Practically speaking, of course, it is about the money. Lying about or withholding information about money can literally lead to financial ruin for the entire family.

But, in the bigger picture, and, when it comes to surviving financial infidelity, it’s about issues central to marriage itself.

After all, at the core of marriage are trust and communication.

And at the core of any type of infidelity are a breach of trust and a lack of (healthy) communication.

Consider that the leading reasons for divorce are extramarital affairs and financial problems. Add in the other top contenders — lack of commitment and constant arguing — and you can see how dangerous financial infidelity is.

Again…trust…communication….

So, how do you go about surviving financial infidelity? (Interestingly, all these tips can also be employed to prevent financial infidelity.)

-

Communicate.

Lying, hiding, and other forms of “creating your own truth” are trespasses of both trust and communication. And sometimes it’s difficult to tell where it all begins.

There are people who are inherently untrustworthy. And there are people who simply don’t have good communication skills.

They don’t know how to share “truth” in a clear, unencumbered way that respects the equality of both spouses and the supremacy of their marriage.

They may even have learned somewhere along the line that telling the truth has negative or painful consequences.

Communication skills are learned. They’re modeled from one’s infancy.

It therefore stands to reason that a couple that comes together in marriage brings two complex histories of communication styles to the altar. If partners don’t examine them before marriage, they will be forced to confront them during marriage.

In terms of surviving financial infidelity, your commitment to healthy communication will be the backbone of your success. Everything that follows is irrelevant without it.

-

Get back to fundamentals to find answers.

Remember what I said before? It’s not about the money. It never is.

Money “represents.” It’s a form of energy, a tangible “commodity” exchanged for the irrevocable commodity of time. And intrinsic to that exchange is a seemingly infinite array of intangibles: values, dreams, learned attitudes and behaviors, life experiences.

As a married couple, you have exclusivity to emotional intimacy. And within that intimacy lies both the privilege of and responsibility to one another’s secrets, fears, hopes, dreams, and vulnerabilities.

The source of financial infidelity, whether from one of you or both of you, is rooted in this place of raw truth and personal history.

Did one of you come from a childhood of deprivation, neglect, or constant struggle? What about the opposite – a family history of wealth, abundance, and unaccountable spending?

Your individual and collective perceptions – about money, people, relationships – are coded on the pages of these histories.

Go back to the archives – lovingly, compassionately, without blame or shame – and watch the answers reveal themselves.

-

Be as transparent as you expect your spouse to be.

If you expect to find out what’s going on in financial secrecy, you have to be as forthcoming as your spouse. You’re a married couple, not roommates.

That means everything financial is on one table.

Does that mean you don’t each get to have “pocket money” to spend on miscellaneous items as you wish?

No. It does mean that nothing is hidden or intentionally withheld or downplayed. No secret accounts, no large purchases without mutual agreement, no hiding purchases, no spending money on people outside your marriage without agreement.

And be completely honest. Always.

-

Do a complete financial review.

Financial infidelity can wreak havoc quickly and indefinitely. And it takes only one person to bring down the whole empire.

Part of getting back onto the same page is fearlessly taking stock of the page(s) you are actually on at that moment in time.

If you feel overwhelmed by the task of reviewing all your finances, or if your finances are complex, bring in a financial expert. Having that knowledge base, experience, and objectivity on board can give you the assurance you seek and the space for relational focus you need.

If you have been keeping separate accounts and finances, this may be a good time to reconsider.

Financial guru David Ramsey has an unequivocal philosophy about married couples keeping separate finances. Click here to read how surviving financial infidelity may require a change in your current arrangement.

-

Update your goals and dreams.

Let’s face it: Money matters are stressful. They’re imbued with so much energy – responsibility, worry, stress, wants, needs.

Go through your typical day and try to come up with something that isn’t in some way touched by money and the need for it. Even the periodic expenditures like hair appointments, prescriptions, and phone bills can be broken down into daily costs.

It can be easy to lose sight of the fact that money, when handled responsibly, is there to help you enjoy life. It’s a measurable step toward your goals and dreams, even if those seem small compared to the lifestyles of the rich and famous.

What matters are your values, your dreams, and your marriage.

Getting in touch with your personal life goals, then looking for common goals with your spouse, will help to revitalize your sense of “us.”

It will also infuse your necessary financial discipline with positivity, motivation, and something to look forward to.

-

Create (and stick to) a spending plan. Together.

If you have worked through the above steps (none of which are “over-and-out”), the idea of a spending plan won’t be such a Debbie Downer.

Your attitude toward sticking to a spending plan will definitely have family-of-origin undertones. It may even be influenced by an unexpected major life event – winning the lottery, losing everything in a natural disaster, getting an inheritance.

What matters is that you and your spouse commit to a new financial paradigm and practice…and stick to it.

Surviving financial infidelity is like surviving sexual infidelity in the sense that transparency and accountability are essential to regaining trust.

-

Get counseling.

None of these steps are easy. If they were, your marriage probably wouldn’t be dealing with financial infidelity in the first place.There is no shame in realizing that you and your spouse didn’t prepare for this part of your marriage. There is also no shame in realizing that your communication, choices, and habits up until now have led to this point.

While each person has to own his/her own choices and contributions, both parties have to own the marriage if it’s going to survive.

As the saying goes, you don’t know what you don’t know. So, if change requires new knowledge in order to make new choices, it only makes sense to go where the knowledge is.

This is the time to make learning your ally. Immerse yourselves in learning both relational skills and financial skills. Knowledge put to good use is a powerful thing.

Surviving any kind of betrayal in marriage comes down to personal and mutual choices on behalf of the relationship. Surviving financial infidelity is no different.

Working on the fundamentals of a healthy marriage will carry over into your financial health.

And healthy finances will carry over into a healthy marriage.

Mary Ellen Goggin offers relationship coaching for individuals and collaborates with her partner Dr. Jerry Duberstein to offer private couples retreats. To learn more about working with Mary Ellen, schedule a ½ hour complimentary consultation.